aurora co sales tax 2021

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. March 8 2021 at 745 pm.

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Aurora Income Tax Information.

. Wayfair Inc affect Minnesota. The County sales tax rate is. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Aurora CO at tax lien auctions or online distressed asset sales.

Aurora CO currently has 2621 tax liens available as of March 31. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County. For tax rates in other cities see Colorado sales taxes by city and county.

Footnotes for County and Special District Tax. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. The Colorado sales tax rate is currently 29.

You can print a 85 sales tax table here. Method to calculate Denver sales tax in 2021. 4 beds 3 baths 2791 sq.

With local taxes the total sales tax rate is between 2900 and 11200. 3 Cap of 200 per month on service fee. The current total local sales tax rate in Aurora CO is 8000.

View sales history tax history. Fourteen states including Colorado allow local governments to collect an income tax. The December 2020 total local sales tax rate was also 8000.

Bright Home Investment Blog Uncategorized aurora co sales tax rate 2021. Colorado has recent rate changes Fri Jan 01 2021. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

Colorado imposes a sales tax on retail sales of tangible personal property prepared food and drink and certain services as well as the furnishing of rooms and accommodations. The Aurora sales tax rate is. Download all colorado sales tax rates by zip code the aurora colorado sales tax is 290 the same as the colorado state sales tax.

The Aurora sales tax rate is 375. Aurora took a major step Monday toward eliminating the citys sales tax on menstrual products putting it in line to. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee.

The Minnesota sales tax rate is currently. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. What is a local income tax.

2 State Sales tax is 290Rank 46Estimated Combined Tax Rate 675 Estimated County Tax Rate 025 Estimated City Tax Rate 250 Estimated Special Tax Rate 110 and. The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. What is the sales tax rate in Aurora Colorado.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Wholesale sales are not subject to sales tax. Method to calculate Aurora sales tax in 2021.

24 lower than the maximum sales tax in CO. The Sales tax rates may differ depending on the type of purchase. March 8 2021 at 748 pm.

Aurora co sales tax rate 2021. There is no applicable county tax. March 20 2021 March 20 2021 By world of cricket.

Did South Dakota v. Real championship 2021 long spine board controversy. File Aurora Taxes Online.

A local income tax is a special tax on earned income collected by local governments like counties cities and school districts. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. Tax Liens List For Properties In And Near Aurora CO How do I check for Tax Liens and how do I buy Tax Liens in Aurora CO.

The County sales tax rate is 0. What is the sales tax rate in Aurora Colorado. The minimum combined 2022 sales tax rate for Aurora Minnesota is.

ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. Select the Colorado city from the list of popular cities. 31 rows The state sales tax rate in Colorado is 2900.

The Aurora Sales Tax is collected by the merchant on all qualifying sales. For tax rates in other cities see Illinois sales taxes by city and county. The County sales tax rate is 025.

Did South Dakota v. City of aurora 375 375. House located at 1166 S Nome St Aurora CO 80012 sold for 550000 on Nov 23 2021.

200 per month on compensation over 250. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month.

The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. With CD 290 000 010 025 375. This is the total of state county and city sales tax rates.

2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. You can print a 825 sales tax table here. 4 Sales tax on food liquor for immediate consumption.

The County sales tax rate is 025. This is the total of state county and city sales tax rates. If the due date 20 th falls on a weekend or holiday the next business day is considered the due date.

Aurora Co Sales Tax Rate 2021 1. Minggu 03 April 2022 Edit The sales tax rate in aurora is 881 and consists of 29 colorado state sales tax. There is no applicable county tax.

The minimum combined 2022 sales tax rate for Aurora Colorado is 8. Aurora-RTD 290 100 010 025 375.

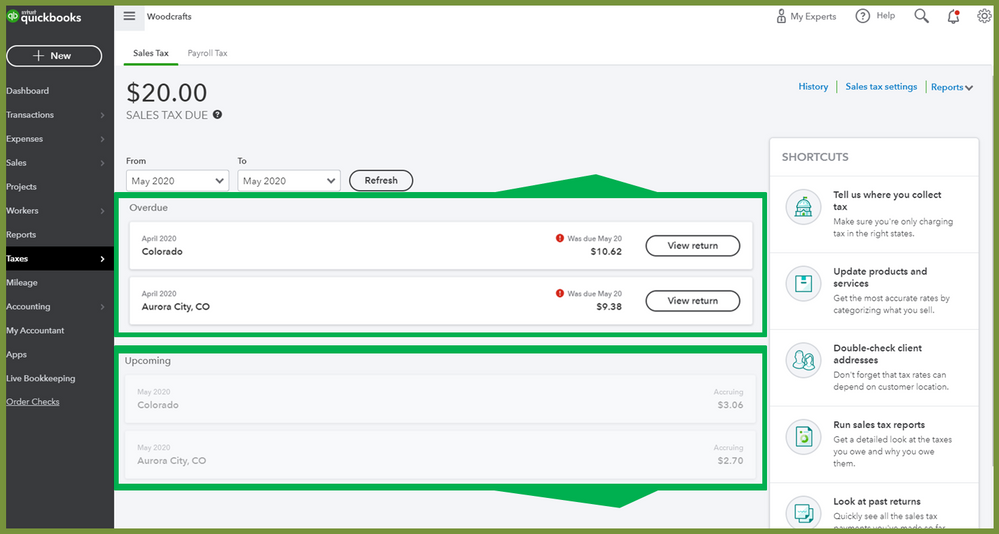

Sales Tax Filing Information Department Of Revenue Taxation

Sales Tax Rates Douglas County Government

23306 E 5th Pl 203 Aurora Co 80018 2 Beds 2 Baths In 2021 Home Home Decor Furniture

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Pay Sales Tax For Small Business 6 Step Guide Chart

How To File The Colorado Retail Sales Tax Return Dr 0100 Using Revenue Online Youtube

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Colorado Sales Tax Rate Changes In April 2022

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

How Colorado Taxes Work Auto Dealers Dealr Tax

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How Colorado Taxes Work Auto Dealers Dealr Tax